Effingham Community Schools Home

Home Page Main

Motto

Upcoming Events

District News

Central Grade School Read-A-Thon

Fundraising starts January 30

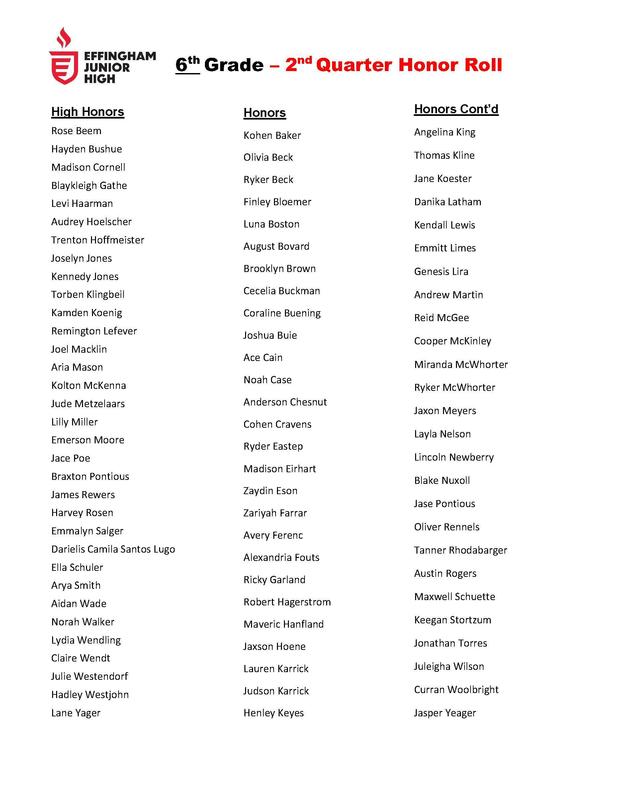

EJHS Honor Roll

2nd Quarter

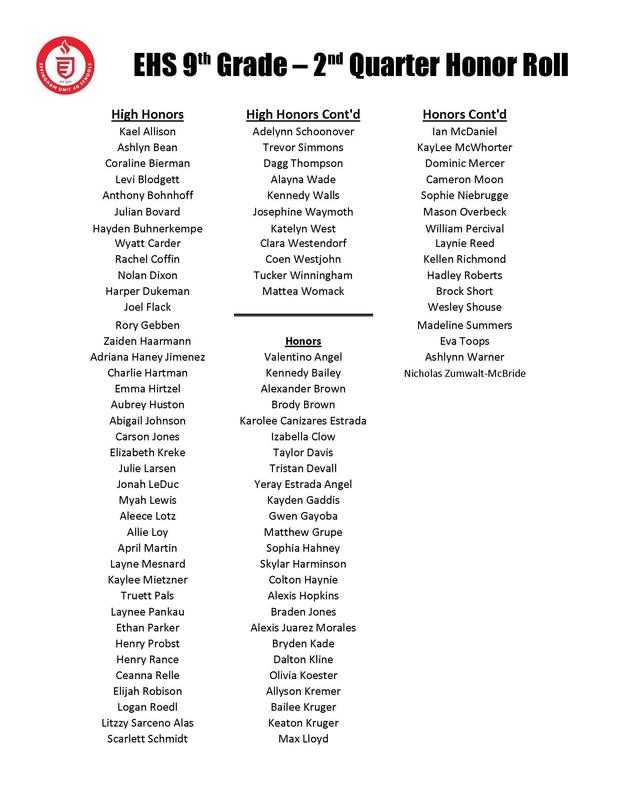

EHS Honor Roll

2nd Quarter

Mustang Mindset Monthly

December M3

Lost & Found

Central Grade School

Messages Accordion Panel

About Us

About Us

The district currently has 2,318 students enrolled. There are a total of 107 children enrolled at Little Hearts, 25 are children of Unit 40 employees. East Side Preschool is home to 130 preschool aged students. ELC is home to 141 kindergarten students. South Side is home to 274 first and second grade students. Central Grade School is home to 498 students in 2nd through 5th grades. Effingham Junior High School has 470 students currently enrolled in grades 6-8. Effingham High School has approximately 718 students enrolled in grades 9-12.

We have 7 Board members elected by the community to set policy and direction for the district. Employees of the district include 16 administrators,190 certified teachers, and 191 classified staff including bus chaperones, bus drivers, cooks, custodians, lunch supervisors, maintenance, nurses, secretaries, and teachers’ aides. The district covers 127.7 square miles.

Thank you, taxpayers and the community, for continuing to support our schools. We spend an immense amount of time trying to create a budget that will provide us with the funds to educate our students in a manner that is very pleasing to our community.

Core Values and Beliefs: In Effingham…

We value individual contributions, opinions, and beliefs to build trust for a successful team.

We respect individuals: their unique lives, passions, and talents.

We honor responsive and coordinated communication.

We celebrate the achievements and victories of all.

We value the respectful exchange of ideas and celebrate our diversity.

We believe the safety of all is crucial for effective learning.

We foster all to realize their potential and develop through personal growth.

Strategic Plan

Strategic Plan

Strategic Plan Goals

Facilities

· Plan and centrally locate Pre-K through 5th grade facilities

· Make all Pre-K through 12 facilities state of the art learning centers

Finance

· Ensure adequate financial resources are in place to achieve the mission, vision and core values of the district

· Allocate finances for competitive compensation to attract and retain quality administrators, teachers and staff

Safety

· Ensure a safe and secure physical learning environment for all students and staff

· Implement a process/system that provides social and emotional support available to both students and staff

Communication

· Implement a Unit 40 strategic marketing plan which includes a cohesive rebrand and highlights self-promotion

· Build a comprehensive and streamlined plan for internal and external communications

Achievement/Curriculum

· Provide exploration opportunities from start to finish that allows for student choice and control

· Ensure challenging curriculum to open doors for all students

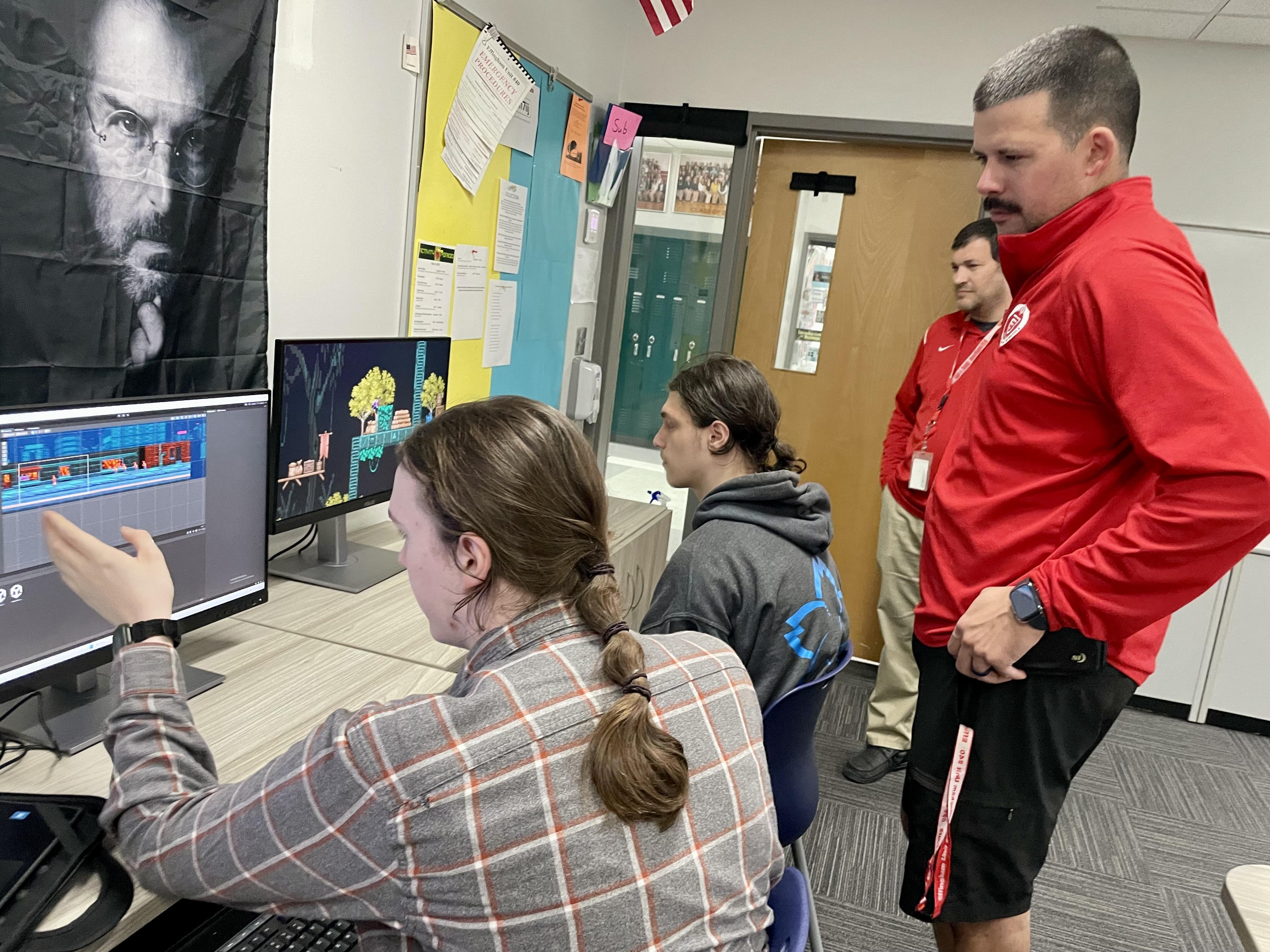

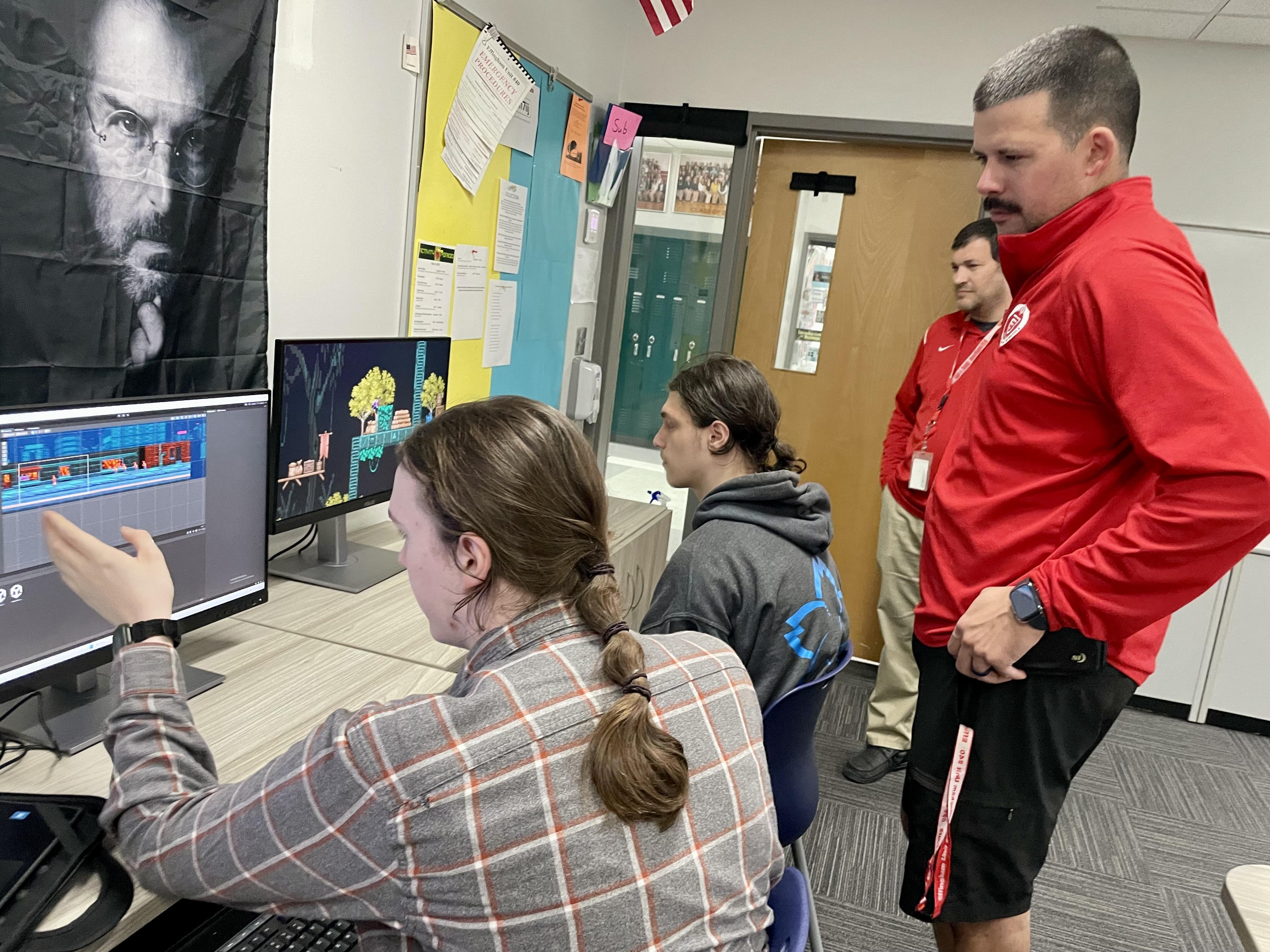

Technology

· To continually integrate the most current technology in all aspects of learning while constantly evaluating

staffing needs

· The opportunity to have hands-on specialized technology

Messages Tab Panel

About Us

The district currently has 2,318 students enrolled. There are a total of 107 children enrolled at Little Hearts, 25 are children of Unit 40 employees. East Side Preschool is home to 130 preschool aged students. ELC is home to 141 kindergarten students. South Side is home to 274 first and second grade students. Central Grade School is home to 498 students in 2nd through 5th grades. Effingham Junior High School has 470 students currently enrolled in grades 6-8. Effingham High School has approximately 718 students enrolled in grades 9-12.

We have 7 Board members elected by the community to set policy and direction for the district. Employees of the district include 16 administrators,190 certified teachers, and 191 classified staff including bus chaperones, bus drivers, cooks, custodians, lunch supervisors, maintenance, nurses, secretaries, and teachers’ aides. The district covers 127.7 square miles.

Thank you, taxpayers and the community, for continuing to support our schools. We spend an immense amount of time trying to create a budget that will provide us with the funds to educate our students in a manner that is very pleasing to our community.

Core Values and Beliefs: In Effingham…

We value individual contributions, opinions, and beliefs to build trust for a successful team.

We respect individuals: their unique lives, passions, and talents.

We honor responsive and coordinated communication.

We celebrate the achievements and victories of all.

We value the respectful exchange of ideas and celebrate our diversity.

We believe the safety of all is crucial for effective learning.

We foster all to realize their potential and develop through personal growth.

Strategic Plan

Strategic Plan Goals

Facilities

· Plan and centrally locate Pre-K through 5th grade facilities

· Make all Pre-K through 12 facilities state of the art learning centers

Finance

· Ensure adequate financial resources are in place to achieve the mission, vision and core values of the district

· Allocate finances for competitive compensation to attract and retain quality administrators, teachers and staff

Safety

· Ensure a safe and secure physical learning environment for all students and staff

· Implement a process/system that provides social and emotional support available to both students and staff

Communication

· Implement a Unit 40 strategic marketing plan which includes a cohesive rebrand and highlights self-promotion

· Build a comprehensive and streamlined plan for internal and external communications

Achievement/Curriculum

· Provide exploration opportunities from start to finish that allows for student choice and control

· Ensure challenging curriculum to open doors for all students

Technology

· To continually integrate the most current technology in all aspects of learning while constantly evaluating

staffing needs

· The opportunity to have hands-on specialized technology